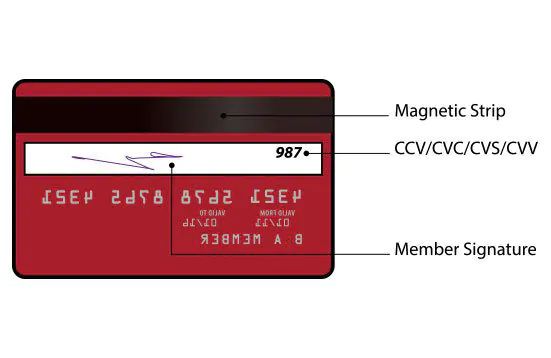

A credit card is specially designed to protect you when you are making any purchases with this card. You may be wondering how the credit card provider can protect you from fraud when you are using your credit card. Several security layers can be used to prevent fraud. One of the best features of a credit card is the credit card CVV. This CVV refers to the three numbers that are located on the backside of your credit card. Before you start using your credit card, you may want to learn more about CVV and the importance of this security feature of the credit card.

The CVV can be called the card verification value. It is an authentication procedure that most credit card companies commonly use. This feature can protect any transactions made with the credit card, especially online transactions. It will function as the most important security feature for the transactions called the “card not present” transactions. Visa, Mastercard, and some popular credit card brands usually use three numbers of CVV on the backside of the credit card. Another popular credit card brand, American Express uses four digits of the CVV number on the credit card.

The CVV was developed by Michael Stone in 1995. It was originally an alphanumeric code with 11 characters. Then, the UK Association of Payment Clearing Service started to adopt the code and revised it into three-digit numbers. The first credit card brand using this number was MasterCard. MasterCard was one of the most popular pioneers in this industry. They issued CVV numbers on their cards in 1997. Then, it was followed by American Express which issued their CVV numbers on their cards in 1999 as a response to the growth of the online transaction. Visa company started to issue this CVV number in 2001 in the United States.

Some credit card providers, such as BPI, Citibank, and also Metrobank require the merchants to ask for the card’s CVV when processing any “card not present” transactions. CVV number is a powerful security feature that is offered by credit cards. For example, when you report the stolen credit card, this three-digit number will prevent any unauthorized transactions from your card. This number can also protect your card, so no one can steal your sensitive information from the card. Because of this importance, you need to keep this number safe and secure.

There are several types of codes that are available in CVV. The three main code types are

CVV is specially created to ensure that you are safe when using your credit card. However, you still need to be aware of the surroundings when using your credit card. Make sure that you keep an eye on the security of your information from your credit card at all times. Try to upgrade your credit card to the EMV-chipped credit card which will add a second layer of protection against any possible theft.

Sometimes you need to enter this code for financial transactions, such as getting a PSbank flexi loan by this link or a loan from a lending company to your card. If this is the case, check the legitimacy of the financial company before providing this information. If the company is legitimate, you can provide the CVV code.

This website uses cookies.

Read More